Ethereum is Unable to Hold above $3,000 as Bears Overwhelm Bulls

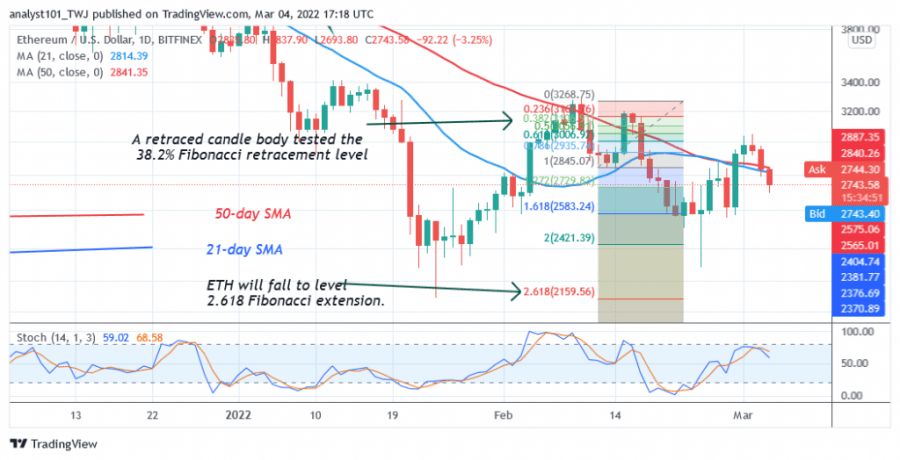

The price of Ethereum (ETH) is in a downtrend after buyers failed to sustain bullish momentum above the moving averages. The largest cryptocurrency fell below the moving averages, indicating further downward movement of the altcoin.

Today, Ether has fallen to a low of $2,737 by the time of writing. The market is falling back to the previous support above $2,500. On the downside, Ethereum will decline and find support above the low of $2,500. However, if the bears break the $2,500 support, ETH /USD will fall to $2,306 or $2,159. Conversely, the uptrend will resume if the Ether price moves back above the $2,500 support and rises again. The Ether price will rally above the moving averages as the bullish momentum extends to the high at $3200.

Ethereum indicator analysis

Ether is at level 46 of the Relative Strength Index for the period 14. The altcoin is in a downtrend area and below the midline 50. The cryptocurrency price is below the moving averages, which indicates a downward price movement. Ether is below the 80% area of the daily stochastic. The market is in a bearish momentum.

Technical indicators:

Major Resistance Levels – $4,500 and $5,000

Major Support Levels – $3,500 and $3,000

What is the next direction for Ethereum?

ETH/USD resumed its downward movement after the price fell below the moving averages. Meanwhile, on February 12, the downtrend, a retraced candlestick tested the 38.2% Fibonacci retracement level. The retracement suggests that ETH will fall to the 2.618 Fibonacci Extension level or $2,159.56.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their research before investing funds.