First Mover Asia: QCP Capital Founder Sees Crypto Industry’s Immediate Future Tied to Genesis Debacle, Expects Rebound in 2024

Analytics

Good morning. Here’s what’s happening:

Prices: Bitcoin returned to its perch comfortably above $17,000 after dipping earlier in the day amid a news report that Binance was the subject of a U.S. federal probe.

Insights: QCP Capital founder Darius Sit told a Tapei Blockchain Week audience that he does not see a recovery before 2024.

Prices

CoinDesk Market Index (CMI) 863.60 +2.5 ▲ 0.3% Bitcoin (BTC) $17,235 +140.3 ▲ 0.8% Ethereum (ETH) $1,277 +13.0 ▲ 1.0% S&P 500 daily close 3,990.56 +56.2 ▲ 1.4% Gold $1,792 −5.7 ▼ 0.3% Treasury Yield 10 Years 3.61% ▲ 0.0 BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Bitcoin Continues Its Side Ways

By James Rubin

A day before they will have a clearer view of the inflation landscape, investors had to reckon with the crypto industry’s latest storm clouds: a report that Binance is the subject of a U.S. Justice Department probe, and later Monday, the arrest of former FTX CEO Sam Bankman-Fried.

Bitcoin tumbled below $16,900 at one point before recovering to recently trade at about $17,235, up slightly over the past 24 hours. BTC has spent much of the past two weeks clinging to support above $17,000 and seems likely to continue its tenacious ways for at least another day when the Bureau of Labor Statistics announces November’s Consumer Price Index (CPI) report.

Inflation has shown signs of continuing its downward trend of recent months. On Wednesday, the U.S. Federal Reserve will likely drop its latest interest rate increase to 50 basis points (bps) from its current streak of 75 bps hikes, although markets are likely to remain nervously watchful for the time being.

“It’s a strong risk-off environment, not just in crypto but across every industry and in every country around the world,” Hany Rashwan, CEO of 21.co, the parent company of crypto exchange-trading fund firm 21 Shares, told CoinDesk TV’s “First Mover” program. “The easiest way of thinking about this is [in] the last 10 years money has been cheaper to acquire, to borrow. As interest rates go up, the value of money becomes higher, so it becomes harder to get, and as a result people spend more carefully.”

Yet, Rashwan added that his firm has “been comforted internally by the plateauing of the bitcoin price within a specific band.”

Ether followed a similar pattern to bitcoin, falling earlier in the day before rebounding. The second-largest crypto by market value was recently changing hands at about $1,275, a small gain from Sunday, same time. Most other major cryptos were in the green, with MATIC, the token of layer 2 platform Polygon, and SUSHI, the token of the Sushiswap decentralized exchange, recently rising about 2% and 1%, respectively.

The CoinDesk Market Index (CDI), an index measuring cryptos’ performance, was recently up 0.23%.

U.S. equity indexes closed in an upbeat mood about inflation and the Federal Reserve’s expected dovish turn. The tech-heavy Nasdaq and S&P 500 rose 1.3% and 1.4%, respectively.

Meanwhile, according to Reuters, the Justice Department has discussed possible plea deals with Binance’s lawyers. Prosecutors in the U.S. Attorney’s Office in Seattle began investigating Binance in 2018 after a spate of cases that saw criminals use Binance to transfer illicit funds, according to Reuters. Other prosecutors believe that more evidence needs to be gathered before a criminal case can be filed, causing a split within the Department of Justice.

Late Monday, the Bahamian Attorney General’s office announced the arrest of Bankman-Fried. “SBF’s arrest followed receipt of formal notification from the United States that it has filed criminal charges against SBF and is likely to request his extradition,” the office wrote in a release. “As a result of the notification received and the material provided therewith, it was deemed appropriate for the Attorney General to seek SBF’s arrest and hold him in custody pursuant to our nation’s Extradition Act.”

Biggest Gainers

Asset Ticker Returns DACS Sector Loopring LRC +2.9% Smart Contract Platform Polygon MATIC +2.0% Smart Contract Platform Terra LUNA +1.7% Smart Contract Platform

Biggest Losers

Asset Ticker Returns DACS Sector Dogecoin DOGE −2.6% Currency Decentraland MANA −1.6% Entertainment Shiba Inu SHIB −1.4% Currency

Insights

Genesis Shakeout Will Determine When Crypto Can Rebound

By Sam Reynolds

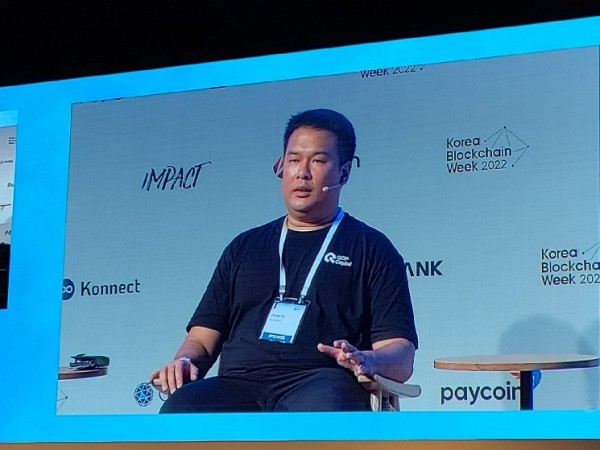

Everything that could go wrong in crypto has gone wrong in crypto, QCP Capital’s founder and chief investment officer said during a panel at Taipei Blockchain Week. But there are still uses for the asset class, and “green shoots” are emerging.

“We are in a credit crisis triggered by LUNA and UST,” QCP’s Darius Sit said on stage, referring to the Terra token and algorithmic stablecoin. “This means there are cascading effects on everyone that had credit risks, and there are still some landmines in the space.”

Sit said that he sees a great reset and washout caused by the credit crisis, which won’t end until investors see whether Digital Currency Group (DCG) and its Genesis Global Trading unit are going to collapse or stay together. (DCG is also the parent company of CoinDesk).

“If this comes apart, there’s another round of defaults,” he said.

Sit pegs a recovery happening around 2024, but macroeconomics will also play a role in this. He noted that the most successful appreciation of digital asset prices came during the COVID-19 pandemic when the U.S. Fed was enlarging its balance sheet. But now the opposite is happening.

As far as the use cases and green shoots go, Sit points to the strength of the stablecoin industry, which Sit says has record revenue. There’s also the continued institutional adoption of the crypto options and derivatives market, where QCP is the most active.

“The trading teams are all former [foreign exchange] people,” Sit said.

If there’s one thing that not even a “dot-com bubble and 2008” can change, it’s that everyone is now talking about crypto, Sit said. Meaning, from the cab driver to the banker to the former FX people now trading crypto options and derivatives. Things like NFTs and Web3 gaming will survive this market cycle – but just at a lower valuation.