EOS Total Value Locked (TVL) Nears $300 Million Milestone

EOS was one of the highest gainers during February, experiencing a 273% spike in its total value locked (TVL).

Launched in June 2018, EOS.io (EOS) is an open-source blockchain platform that claims to eliminate transaction fees while assisting developers, businesses, and investors build dApps.

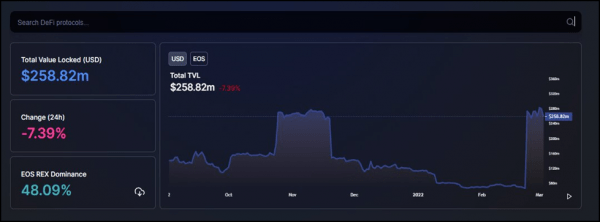

EOS Network’s TVL as of March 1, was up 23.3 million when compared to February 2022 – an 8.9% increase.

While February didn’t provide much favor for many blockchain protocols, platforms like EOS and Theta Network experienced impressive gains, with Theta seeing a relatively higher percentage change than the EOS network, coming in at a TVL of $212 million.

By the end of the month, EOS’ TVL was at $259.94 million, according to Be[In]Crypto Research.

A figure below $300 million is relatively small in today’s market, where billions are locked in, including Klaytn (KLAY), Polkadot (DOT), Cronos (CRO), Fantom (FTM), Binance Smart Chain (BNB), Ethereum (ETH), Waves (WAVES), Osmosis (OSMO), and Terra (LUNA).

EOS reached new milestones in October 2021

As one of the pioneer smart contracts-backed blockchain technology, EOS’ TVL appeared on DeFillama, a data aggregating platform in September of last year.

Looking at September’s report, its TVL was at $140.41, eventually decreasing to $117.46 million to close out the third quarter of 2021.

The following month, its TVL reached staggering figures, making a 58% rally within 24-days. With a 45% increase in just 24-hours, EOS’ TVL jumped from $185 million on October 24 to $270 million the following day.

With a slight increase of 2%, the platform reached a new all-time high in TVL of $277.28 million on November 10, 2021, due to the bullish engulfing of the crypto finance market for tokens and DAPPS.

A sharp decline in TVL ensued which brought total liquidity to $113.03 million by the end of 2021.

After opening at $112.15 million on the first day of 2022, the platform’s TVL plunged by 39% to settle at $68.06 million on January 31, 2022.

TVL nears $300 Million in March

Russia’s unprovoked invasion of Ukraine in February certainly didn’t bode well for digital assets, despite the community coming together to help send resources to Ukraine.

On the day of the invasion, EOS opened at $2.11, reached an intraday high of $2.12, and fell by 11% to an intraday low of $1.87. The selling pressure was highly evident in the monthly high trading volume of $734 million recorded on the day.

After closing February just under $260 million, there was a rise in TVL over 24 hours to approximately $283.24 million on March 1, marking its gradual steps towards breaking the $300 million milestone.

Source: DeFillama

Overall, the monthly percentage change in the EOS’ TVL stands at 274%, as of press time.

EOS REX and DeFiBox to thank for TVL increment?

Several projects have been invaluable to the fortunes of EOS. Among them are BetHash, NewDex, Sportbet, TrustDice, and Equilibrium-EOSDT.

With that said, the biggest gainers for the blockchain platform over this booming period have been EOS REX ($128 million in TVL) and DeFiBox ($53.73 million in TVL). These DAPPS fall under the decentralized lending umbrella that has seen increasing demands over the months due to the decent periodical yields they provide.

Source: DeFillama

EOS developer activity continues to boom

In a market of more than 17,000 crypto projects fighting for the same virtual numbers, the EOS Network continues to see consistent developer activity over time.

Source: Sanbase

With several projects in the making, the deployment of more DAPPS in this ecosystem should see a substantial rise in TVL.